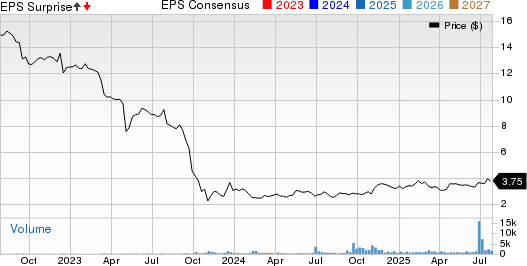

Blue Ridge Bankshares Plummets Despite Q2 Profit Return

Performance Overview of Blue Ridge Bankshares, Inc.

Shares of Blue Ridge Bankshares, Inc. (BRBS) have experienced a decline of 5.1% since the company released its earnings for the quarter ending June 30, 2025. This performance contrasts with the S&P 500 Index, which saw a 0.9% gain during the same period. Over the past month, BRBS managed to rise by 4.5%, outperforming the S&P 500’s 1.7% increase.

Earnings Snapshot

For the second quarter of 2025, Blue Ridge Bankshares reported a net income of $1.3 million, or $0.01 per diluted share, compared to a net loss of $11.4 million, or ($0.47) per share, in the same period last year. This marks a significant return to profitability, driven by improved net interest margins and reduced non-interest expenses. The results also show an improvement from the $0.4 million loss recorded in the first quarter of 2025.

Net interest income for the quarter stood at $19.8 million, relatively flat compared to $20.1 million in the second quarter of 2024. The decrease in interest and fee income on loans due to lower average balances was partially offset by reduced funding costs. The company recorded a $0.7 million recovery of credit losses against a provision of $3.1 million in the previous year’s quarter.

Non-interest income increased to $3.2 million from $0.3 million in the prior year’s quarter, attributed to better service charges and the receipt of previously withheld mortgage servicing rights proceeds. Non-interest expenses dropped by 24.9% to $22 million from $29.3 million a year earlier, supported by cost-cutting measures such as headcount reductions.

Key Business Metrics

Blue Ridge Bankshares’ net interest margin improved to 3.15% from 2.90% in the first quarter and 2.79% a year ago, primarily due to a decrease in deposit costs. The cost of funds fell to 2.63% from 3.02% year over year, while the cost of deposits declined to 2.47% from 2.84%. Excluding wholesale deposits, the cost of deposits plummeted to 1.01% from 2.28% in the same quarter last year.

Total assets decreased to $2.56 billion from $2.69 billion in the first quarter and $2.93 billion a year earlier. Loans held for investment declined 12.4% year over year to $1.98 billion from $2.26 billion a year earlier, resulting from strategic reductions and paydowns, especially in out-of-market exposures. Deposits were down 13.6% year over year to $2.01 billion from $2.33 billion a year earlier. Brokered deposits as of June 30, 2025, were $296.1 million, a decline of $43 million from March 31, 2025, and $168.3 million from June 30, 2024. Liquidity remained strong, with $750 million in available liquidity sources representing 183.3% of uninsured deposits.

Non-performing loans remained stable at $24 million, or 0.94% of total assets. The allowance for credit losses stood at 1.11% of total loans, with net loan charge-offs of $0.5 million compared with $0.1 million in recoveries in the first quarter. On the capital front, Blue Ridge Bankshares’ tangible common equity to tangible assets ratio improved to 13.4% from 10.3% a year earlier. Tangible book value per share rose to $3.85 from $3.83 in the first quarter.

Management Commentary

President and CEO G. William “Billy” Beale highlighted the quarter as a turning point, marking the first profitable half since a series of regulatory and operational challenges began. Beale cited improvements in net interest margin, disciplined cost management, and reduced deposit costs as primary factors behind the results. The CEO acknowledged headcount reductions—109 during the first half and 170 since the end of the second quarter of 2024—as part of broader efforts to streamline operations. He also emphasized a cultural shift, describing the organization’s transition from “fixers” to “growers” as remediation efforts near completion.

Factors Influencing Headline Numbers

A mix of one-time and structural factors influenced the second-quarter 2025 results. The $1.8 million pre-tax income included a $1.3 million benefit from the recovery of prior reserves associated with a discontinued fintech banking-as-a-service partner and $0.3 million in severance costs. The reduction in interest-bearing deposits and their cost profile directly boosted net interest income, despite a decline in average interest-earning assets.

On the expense side, the 4.1% sequential reduction in non-interest expense stemmed partly from fewer employees, even as $2 million was expensed for performance-based restricted stock awards.

Guidance and Future Outlook

Although explicit forward guidance was limited, management reaffirmed expectations of achieving an annualized non-interest expense-to-assets ratio below 3% by the fourth quarter of 2025. CEO Beale noted a slowing pace of loan and deposit runoff and signaled that the company’s focus is shifting toward growth. BRBS anticipates continued operational improvement and expects further cost reductions in upcoming quarters.

Additionally, Blue Ridge Bankshares believes it is nearing the completion of regulatory remediation stemming from the January 2024 consent order, having already surpassed required capital thresholds.

Other Developments

On March 27, 2025, Blue Ridge Bankshares completed the previously announced divestiture of Monarch Mortgage. The transaction, involving asset and lease transfers to an unrelated entity, resulted in a $0.2 million loss year to date. As of June 30, all in-process loans at the time of the sale had been closed, funded, and sold. This strategic move is part of BRBS’ broader plan to realign its business model toward traditional community banking and away from mortgage origination and fintech partnerships.

Blue Ridge Bankshares also redeemed $15 million in subordinated debt and partially redeemed an additional $10 million of its 2029 Notes, actions that will support future interest expense reductions.

Which one are you watching, Xplorianz? Drop your take on the most underrated pick this week in the comments!. Slide into our inbox Facebook, or tag us on X . Stay sharp, stay weird, and keep Xploring

Disclaimer:

This article is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions, your money, your call. Crypto’s wild, so stay sharp out there!

No Comments