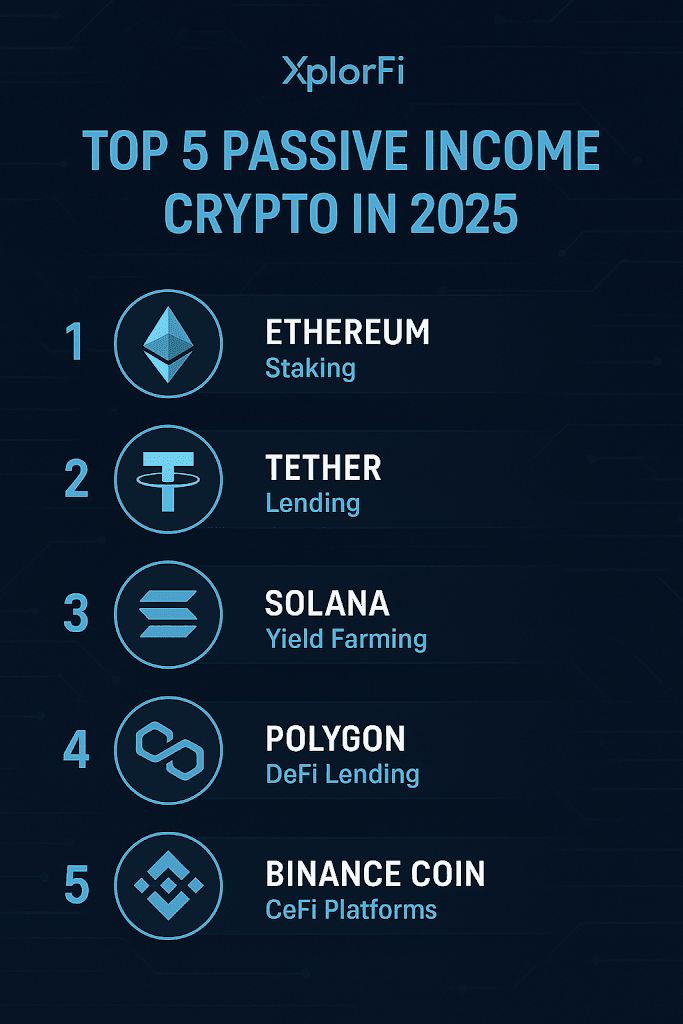

Top 5 Best Passive Income Crypto in 2025

Top 5 Passive Income Crypto in 2025. Wanna be a crypto millionaire? If you’re looking to stack some cash without breaking a sweat, you’ve hit the jackpot! In the wild world of digital coins, passive income is the name of the game, and 2025 is shaping up to be a smasher for opportunities. From staking to yield farming, there are loads of ways to keep your wallet buzzing while you chill. So, buckle up, and please continue reading!

Overview of the Crypto Market in 2025

So check it out! The crypto market in 2025 is lit, no cap. We’re seeing mad adoption everywhere, with peeps using digital coins for everyday buys, like it’s no big deal. Bitcoin’s still king, but altcoins are flexin’ hard, especially those with sick tech and real use cases.

NFTs are still poppin’, but now they’re more about utility than just art. Regulatory vibes are chillin’ too, with clearer rules makin’ it easier for everyone to jump in. Plus, decentralized finance is blowing up, giving folks mad options to earn some passive income.

Criteria for Selecting Passive Income Cryptos

When you’re lookin’ to snag some passive income from cryptos, ya gotta scope out a few key things, ya know? First off, check the coin’s utility; if it’s got real-world use, it’s more likely to stick around. Then, peep the team behind it—are they legit or just some randoms? Ya also wanna look at the staking options; the better the rewards, the sweeter the deal. Don’t sleep on the community, either; strong vibes mean more support.

Top 5 Best Passive Income Cryptos Revealed

if you’re lookin’ to stack that cash without breakin’ a sweat, crypto’s the way to go! First up, we got Cardano, super chill with its eco-friendly vibes, makin’ it a solid choice. Next, check out Tezos; it’s like the cool kid on the block, givin’ you sweet rewards for just holdin’ it. Then there’s Stellar, perfect for those cross-border transactions, makin’ your money moves smooth. Don’t sleep on Chainlink either; it’s all about connectin’ the dots in the DeFi world. Finally, we can’t forget about Polkadot, linkin’ different blockchains like a boss.

1. Staking: Chill and Earn

Staking is like, the most popular way to earn passive income with crypto, fam! You just hold onto your coins and validate transactions on the blockchain network, and you’ll get rewarded.

How to Staking, Bro?

1. Choose a staking platform: Pick a reputable staking platform that suits your needs, yeah!

2. Select a cryptocurrency: Choose a cryptocurrency that you want to stake, fam!

3. Follow the staking process: Follow the staking process according to the platform’s instructions, easy peasy!

Perks of Staking, Yo!

1. Passive income: Staking gives you regular passive income, bro!

2. Supports the blockchain network: Staking helps support the security and stability of the blockchain network, yeah!

3. Flexibility: You can stake various types of cryptocurrencies, fam!

Risks of Staking, Though

1. Security risks: Staking can be risky if the platform or wallet isn’t secure, bro!

2. Volatility risks: Cryptocurrency values can fluctuate significantly, yeah!

3. Technical risks: Staking can be hindered by technical issues, fam!

By understanding how staking works, its perks, and risks, you can make informed decisions to start staking and earn passive income with crypto, bro!

2. Yield Farming: Lend and Earn

Yield farming is like, lending your crypto to decentralized platforms and earning interest, bro! You provide liquidity to these platforms, and in return, you get rewarded with interest or tokens.

How it Works,

1. Choose a platform: Pick a reputable yield farming platform, like Aave or Compound, fam!

2. Deposit crypto: Deposit your crypto into the platform’s liquidity pool, easy peasy!

3. Earn interest: Earn interest on your deposited crypto, bro!. For example:

Aave: 2-20% returns, depending on the asset, fam!.

Compound: 10%+ returns, yeah, it’s a big deal!.

Perks of Yield Farming

1. High returns: Yield farming can offer high returns, especially for popular assets, yeah!

2. Diversification: You can diversify your portfolio by lending different assets, fam!

3. Passive income: Yield farming provides passive income opportunities, bro!

Risks to Consider

1. Smart contract risks: Yield farming platforms rely on smart contracts, which can be vulnerable to exploits, bro!

2. Liquidity risks: If the platform’s liquidity pool dries up, you might not be able to withdraw your funds, fam!

3. Market volatility: Crypto market volatility can impact the value of your deposited assets, yeah!

3. Lending: Lend and Earn

So, you’ve been HODLing your Bitcoin, ETH, or maybe some stablecoins like USDT and USDC. They’re just chillin’ in your wallet, not doing much. But here’s a move you gotta know—crypto lending.

It’s one of the smoothest ways to let your bag earn passive income while you sleep. Your crypto doesn’t have to just sit there—it can grind for you 24/7.

What Is Crypto Lending?

Crypto lending is basically playing the bank. You deposit your coins into a lending platform and let others borrow ’em. In return, you get interest. No charts, no trading stress—just your crypto stacking yield.

It can be through DeFi platforms like Aave or Compound, or CeFi options like Nexo or Binance Earn.

Best Crypto Coins to Lend

Wanna start lending but not sure what coins to use? Here are the go-to picks:

- Bitcoin (BTC) – Safe choice, steady demand.

- Ethereum (ETH) – Popular on most lending protocols.

- Tether (USDT) – Stablecoin with consistent returns.

- USD Coin (USDC) – Clean reputation, great for passive plays.

- Dai (DAI) – Decentralized and DeFi-native.

- Solana (SOL) – Fast chain, solid DeFi scene.

- Polygon (MATIC) – Low gas = more profits.

- Avalanche (AVAX) – Lending options on Avalanche dApps.

- Chainlink (LINK) – Sometimes available, depending on platform.

- Binance Coin (BNB) – Good on Binance Earn and BNB Chain dApps.

Risks? Yeah, There Are Some

Nothing in crypto is risk-free. With crypto lending, you gotta watch out for:

- Smart contract bugs

- Platform rug pulls

- CeFi companies locking withdrawals

That’s why it’s key to DYOR (do your own research), avoid YOLO-ing your whole stack, and start small. Stick with trusted names like:

Let Your Coins Do the Work

If you’re holding long-term, why not put your assets to work? Lending crypto is a solid passive income strategy—just make sure to manage the risks.

Your coins can do more than just sit there. Let them hustle. Let them earn. Welcome to the future of passive income.

4. NFT Royalties: Create and Earn

NFT royalties are like creating and selling NFTs and earning passive income from royalties. It’s a pretty cool way to monetize your art, bro! For example:

– Ethereum: 10%+ returns, yeah!

– FLOW: 5-10% returns, not bad!

5. Crypto Savings Accounts: Save and Earn

Crypto savings accounts are like saving your crypto and earning interest. It’s a pretty low-risk way to earn passive income, bro! For example:

– Binance: 2-10% returns, depending on the asset, fam!

– Coinbase: 1-5% returns, yeah!

So, bro, are you ready to start earning passive income with crypto? Just remember to do your research and understand the risks, yeah!

To Wrap Up

So there you have it, the top 5 best passive income cryptos to keep an eye on in 2025! These gems could totally boost your wallet while you chill. Remember, always do your homework and stay savvy in the crypto game.

Thanks for vibing with us on this journey! Don’t forget to share this article with your crew, and catch you next time for more dope insights. Peace out!

Still tryna find that one gem to make it out the rat race?

Don’t sleep on these coins, fam — we dropped the real alpha in here.

👉 Check the full list of crypto that might just change your world in 2025 💸While these passive gems are solid, the king still roars. Bitcoin’s run to $200K? It’s not just hype — it’s money on the move.

💸 See who’s cashing in on BTC big time.

Yo Xplorianz, Got spicy takes or want us to dig into your favorite project? Slide into our inbox Facebook, or tag us on X . Stay sharp, stay weird, and keep Xploring.

XplorFi Crew, out.

Disclaimer:

This article is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions, your money, your call. Crypto’s wild, so stay sharp out there!

9 month ago

[…] Top 5 Best Passive Income Crypto in 2025 […]

9 month ago

[…] Top 5 Best Passive Income Crypto in 2025 […]

9 month ago

[…] interested in how these cycles affect income-generating opportunities, check out our deep dive on Top 5 Passive Income Crypto Opportunities in 2025 — it’s perfect for building wealth while you […]