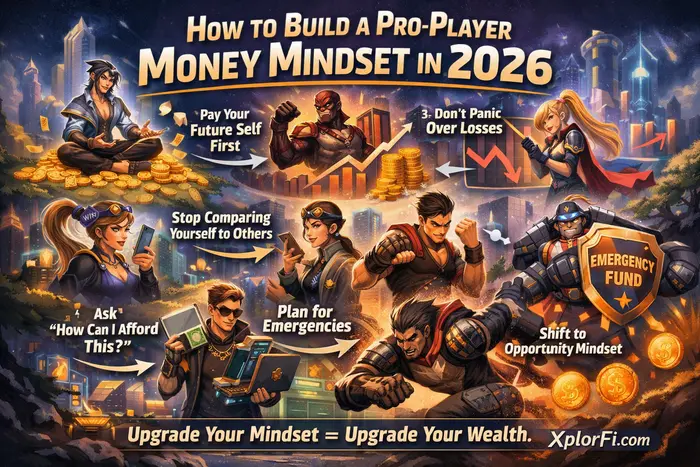

How to Build a Pro-Player Money Mindset in 2026

Yo yo yo, Xplorianz — loyal squad of XplorFi.com 🎮💸

“From late-night grinding games to checking crypto gains,

If your wallet feels pain — yo, the mindset’s to blame.”

Today we’re not talking about boring spreadsheets or “stop buying coffee” advice. Nah. We’re diving into the money mindset — the mental patch update most people skip while wondering why their finances keep lagging like a potato server. If you’ve tried budgeting, saving, even side hustling, but still feel stuck… bro, sis, maybe it’s not your actions. It’s your thinking OS that needs a reboot. Let’s roll.

If you’ve tried budgeting, saving, or even side hustling but still feel stuck… bro, sis, maybe it’s not your actions. It’s your thinking OS that needs a reboot. —

The Meta-Shift: Noob vs. Pro Mindset

| Feature | Noob Mindset (Scarcity) | Pro Money Mindset (Growth) |

| Payday | Pay bills, spend, save the “scraps” | Pay Future Self First (Auto-invest) |

| Market Dip | Panic sell / Rage quit | DCA / Hold for the late-game power spike |

| Mistakes | “I’m just bad with money” | “Found a bug, patching it now (XP)” |

| Big Buys | “I can’t afford that” | “How can I strategically afford this?” |

1. Pay Your Future Self First — Like Ling Prioritizing Buffs Before War

(Money mindset starts before the fight even begins)

Most people pay rent, food, subscriptions, impulse buys… and if there’s anything left, maybe savings. That’s backward gameplay. The core money mindset shift is this: you pay your future self first.

Automating savings or investments (401(k), ETFs, even safe crypto allocations) means you’re securing late-game loot before early mobs drain your HP. According to data shared by Investopedia, automated investing dramatically increases long-term wealth because it removes emotional decision-making.

Think of it like Ling in Mobile Legends. He doesn’t jump into war without energy and buffs. You shouldn’t jump into life without paying your future version first. No buff? No survival.

2. Think Long-Term, Not Instant Legendary Skin

(Compound interest = slow XP, insane power-up)

If your money mindset expects instant results, you’ll quit early. Wealth isn’t a TikTok trend — it’s a long-form YouTube documentary.

Compound interest works quietly. According to NerdWallet, investing early — even small amounts — can outperform larger late investments due to time. You may not feel rich next year, but 10–20 years later? Different story.

This is like Aldous stacking souls. Early game? Weak. Late game? One punch, one KO. If you rage quit before stacks build, you’ll never feel the power.

4 Tips to Achieve Money Goals For 2026

3. Stop Panicking Over Short-Term Losses

(Markets dip like Layla’s early-game damage)

Markets go up. Markets go down. Crypto especially loves drama. But a healthy money mindset understands volatility is part of the grind.

Selling everything during a dip locks in losses. Historical data from Morningstar shows that investors who stay consistent outperform those who jump in and out due to fear.

That’s like quitting ranked because Layla got bullied in minute three. Bro… late game exists. Chill. Protect your mental, protect your portfolio.

4. Turn Financial Ls Into XP

(Even Chou missed kicks before mastering combos)

Mistakes happen. Bad trades. Overspending. Buying hype coins at ATH (we’ve all been there 😭). The wrong money mindset says: “I’m bad with money.”

The right one says: “What did this teach me?”

Psychologists call this a growth mindset, and it applies heavily to finance. Learning from mistakes builds decision-making skills. Avoiding reflection just repeats the cycle.

Chou didn’t master combos overnight. He got smacked, adjusted, trained, and dominated. Same with money.

5. Stop Comparing Your Wallet to Other Players

(Your lane ≠ their lane)

Scrolling Instagram seeing people flex cars, crypto screenshots, “day in my life” videos? Dangerous for your money mindset.

Comparison kills satisfaction. According to behavioral finance studies cited by Harvard Business Review, comparison-driven spending increases debt and stress.

Your win might be paying off one credit card. That’s still a win. Focus on your progress, not their highlight reel.

Like Mobile Legends roles — Tank doesn’t chase MVP kills. He wins by doing his job. Play your role.

6. Ask “How Can I Afford This?” Instead of “I Can’t”

(Problem-solving mode: ON)

A powerful money mindset shift is changing the question. “I can’t afford this” ends the conversation. “How could I afford this?” opens creativity.

Maybe it means adjusting subscriptions, increasing income, delaying gratification, or investing smarter. This is budgeting as strategy, not punishment.

Think of Claude farming jungle faster to reach item power spike instead of crying about being under-leveled. Adapt. Don’t freeze.

The Strategy in Action: Let’s say you want to go on a legendary snorkeling trip that costs $600.

- Noob Mindset: “I can’t afford that, it’s too expensive.” (Brain shuts down).

- Pro Mindset: “How can I get $600 in 4 months?” → That’s **$150/month**.

- The Farm: You cut one unused sub ($10), cook at home twice a week ($100), and sell some unused gear ($40).

Boom. You didn’t get a “cheat code,” you just optimized your build path to unlock the reward.

🏝️ PRO-PLAYER REWARD: Now that you know how to fund your adventures, where are you heading first? If you’re looking for the ultimate map to test your new mindset, we’ve got you covered:

👉 13 Best Snorkeling Spots in Indonesia: The Ultimate Reward for Your Grind

“Saying ‘I can’t afford it’ is usually a full stop, not the truth. A pro-level money mindset asks a better question: how can I afford it? That single shift turns money from a dead end into a strategy game — cutting useless spending, boosting income, and reallocating resources instead of giving up. Same wallet, new thinking, better outcome.”

7. Plan Before Crisis Hits

(Emergency fund = Winter Truncheon IRL)

Most people change financially only when disaster hits. Job loss. Medical bills. Crypto winter. A solid money mindset prepares before chaos.

Experts from CNBC suggest having at least 3–6 months of emergency savings. That fund isn’t “wasted money” — it’s mental armor.

Winter Truncheon saves you when things go wild. Same energy.

8. Shift From Scarcity to Opportunity

(Don’t hoard gold like a scared Goblin)

Scarcity mindset makes you scared to invest, scared to spend, scared to move. Opportunity-focused money mindset says: “When is it smart to deploy resources?”

If you’re young, time is your biggest asset. You can afford calculated risks. According to Vanguard, younger investors benefit more from growth-focused strategies due to recovery time.

That’s like Roger knowing when to all-in. Timing matters. Fear blinds opportunity.

Bottom Line: Upgrade the Mindset, Upgrade the Wallet

Your financial future isn’t just about income, budgeting apps, or side hustles. It’s about how you think about money. A strong money mindset reduces stress, improves decisions, and builds sustainable wealth, even when cash flow feels tight.

If you want deeper personalization, talking to a certified financial planner or advisor can help align strategy with goals. But the first upgrade? It’s mental.

Remember, Xplorianz:

Change the mindset → change the moves → change the money.

Just like in Mobile Legends… no hero wins without the right build.

See you in the next grind,

Your chill finance bro from XplorFi.com

Disclaimer: This content is for educational and entertainment purposes only (XplorFi style). Nothing here is financial advice. The crypto market is volatile; you can lose your lunch money. Do your own research (DYOR) before buying anything.

READ MORE:

5 Simple Ways to Ease Financial Stress Now

Low-Cost Index Funds: The Best Choice for Investors 2025?

No Comments