Alibaba 2025: Why BABA Stock Is a Smart Buy

Alibaba Making That Sweet Comeback

Man, Alibaba is straight-up flexing in 2025. After getting dunked on for years during China’s tech crackdown, the company just pulled off an insane comeback, its stock (BABA) skyrocketed almost 70% year-to-date. That’s like watching Balmond go from 1/10/0 in early game to a full-item beast by late game, just spinning his axe through every opponent on the map. Investors who had written Alibaba off are now looking like they just missed the kill steal of the season.

This rebound ain’t just luck, though. Alibaba’s been pushing hard into AI, and China’s government is now backing domestic companies to go head-to-head with the U.S. in the tech war. Think of it as the final match of M-World Championship, but instead of heroes, it’s algorithms battling for dominance. And right now, Alibaba is the one holding the Lord buff.

Alibaba’s AI Grind Mode Activated

AI has become Alibaba’s ultimate power-up, especially inside its Cloud Intelligence Group. The division’s revenue jumped 26% in the June quarter, with AI alone taking up 20% of external customer revenue. That’s eight straight quarters of triple-digit AI growth, bro, that’s like Aldous farming stacks non-stop without ever recalling.

This AI grind has caught investors’ attention big time. Everyone’s realizing Alibaba ain’t just an e-commerce giant anymore, it’s becoming a full-blown AI juggernaut. And in true MLBB style, it’s not about brute force; it’s about timing your skills and combos right. Alibaba’s combo? Cloud + AI + data dominance = OP build for 2025.

Mixed Q1 Earnings but Strong Comeback Energy

Alright, not everything was sunshine and rainbows. Alibaba’s Q1 2026 earnings were kinda mixed. The company pulled in $34.57 billion in revenue (up 2%), but if you remove the dead weight from sold businesses, growth was closer to 10%. Still, it fell a bit short of analyst expectations, like when your Layla ulti hits the wrong target.

Operating income dropped 3%, but net income? Boom up 76% year-over-year to $6.01 billion. That came mostly from investment gains and asset disposals, so not pure operational juice. Still, the company’s instant commerce arm, which now has 300 million monthly users, kept the vibes strong. Kinda like when Claude’s just farming in peace and waiting for his moment to pop off.

Alibaba’s Big Bet on AI and Innovation

The real story here is Alibaba’s obsession with AI. The word “AI” popped up so much during the earnings call, you’d think it was the company’s new middle name. Management basically said, “Forget old-school e-commerce for a sec, AI is our new playground.”

They’re even developing their own AI chip, meaning they might not have to depend on Nvidia anymore. Imagine Alucard saying, “I don’t need no buff, I am the buff.” That’s Alibaba right now, self-sufficient, focused, and hungry for innovation. If this chip plan pays off, Alibaba could unlock a whole new revenue stream serving third-party clients too.

Low-Cost Index Funds: The Best Choice for Investors 2025?

Partnerships That Push Alibaba Into Global League

Alibaba’s not just playing solo, it’s teaming up with heavyweights like BMW, SAP, and Apple. These partnerships are clutch, especially since China’s strict data rules mean foreign firms must partner with local players to offer AI services. That’s Alibaba swooping in like Chou with a perfectly timed kick,disruptive, precise, and unstoppable.

These collabs give Alibaba front-row access to massive markets and real-world AI integration. It’s not just building tools; it’s shaping how the global AI economy will flow through China. That’s the kind of positioning that could turn the company from regional powerhouse into a global MVP.

Analysts Are Loving It – BABA Gets the Buff

After the latest earnings drop, analysts came through with their own “well played” stickers. Heavy hitters like Benchmark, BofA, Barclays, and J.P. Morgan all bumped up their price targets. Benchmark even went wild and slapped a $195 target on Alibaba’s stock, literally the Street-high.

Out of 22 analysts surveyed, most rate Alibaba as a “Strong Buy”, with an average price target around $167.84, or 16% above the current level. It’s the financial equivalent of Rafaela dropping her ultimate heal across the team, confidence, optimism, and momentum are back.

Is It Worth Investing in Alibaba Right Now?

So here’s the big question: should you jump in? Alibaba’s forward P/E ratio of 19.1x might look a bit steep, but it makes sense when you consider their long-term AI and instant-commerce game plan. Yeah, there are some short-term bumps ahead, like every MLBB player knows, you gotta survive the ganks to reach late game.

But in the long run, Alibaba looks stacked. China’s government is now playing support role, buffing tech firms instead of nerfing them. Combine that with Alibaba’s two main win conditions, AI and e-commerce, and you’ve got a squad that’s ready for championship play. Investors holding their positions are basically channeling their inner Tigreal: patient, strategic, and waiting for the right moment to slam down the ulti.

Why Alibaba’s Future Looks Bright

Alibaba’s transformation into an AI-first company feels like watching a hero evolve mid-game. It’s not just surviving the meta—it’s shaping it. With the Cloud division booming, partnerships expanding, and a government finally cheering from the sidelines, the company’s future looks mad solid.

Sure, there’s still risk. Competition’s heating up faster than Ling after grabbing blue buff, and execution will be key. But the direction? Spot on. If Alibaba continues this trajectory, it could redefine what “Made in China” means in the era of artificial intelligence.

Final Takeaway:

Alibaba’s comeback story in 2025-2026 is the definition of “never count a legend out.” The company has rebuilt its identity around AI, doubled down on innovation, and pulled off an insane rally in its stock. It’s got the strategy, the partnerships, and the momentum all that’s left is execution.

So yeah, Alibaba might’ve taken a few tower hits in the past, but now it’s pushing mid with full HP and all its ultimates ready. If the AI revolution is a Mobile Legends match, Alibaba just re-entered the fight with Savage potential.

Yo Xplorianz, Got spicy takes or want us to dig into your favorite project? Slide into our inbox Facebook, or tag us on X . Stay sharp, stay weird, and keep Xploring.

BlockDAG Surpasses $410M with BWT Alpine F1 Deal

Top Free PC Games 2025

Video Summarizers: The Next Era of Content 2025

Disclaimer:

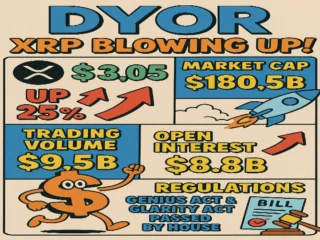

This article is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions, your money, your call. Crypto’s wild, so stay sharp out there!

No Comments