ENSG’s Q2 Earnings Surpass Expectations as Occupancy Rises, Stock Jumps 9%

Strong Performance and Strategic Moves Drive Ensign Group’s Growth

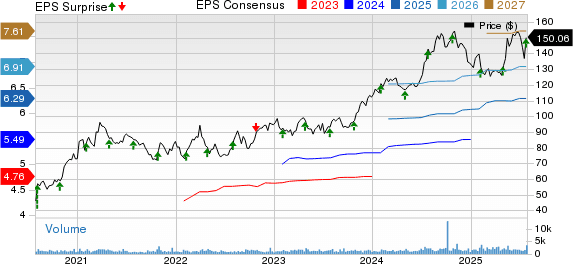

Shares of The Ensign Group, Inc. (ENSG) saw a significant rise of 8.9% on July 25, driven by strong financial results for the second quarter of 2025. The company’s performance was supported by robust revenue growth in its Skilled Services segment, improved occupancy rates, and solid gains in rental revenues. Additionally, an upward revision in the 2025 adjusted earnings per share (EPS) guidance contributed to positive investor sentiment. However, this momentum was partially tempered by higher expenses due to increased service costs, rent, and general administrative expenses.

Key Financial Highlights

In the second quarter of 2025, Ensign Group reported an adjusted EPS of $1.59, which exceeded the Zacks Consensus Estimate by 3.3%. This marked a 20.5% year-over-year improvement in the bottom line. Operating revenues surged 18.5% year over year to $1.2 billion, surpassing the consensus estimate by 1.8%.

The company’s adjusted net income for the quarter reached $93.3 million, representing a 22.1% increase compared to the same period last year. Same-facilities occupancy improved by 160 basis points (bps), while transitioning-facilities occupancy rose by 370 bps year over year.

Total expenses climbed 18.3% year over year to $1.12 billion, slightly exceeding the estimated $1.08 billion. Despite this, the company maintained a strong financial position with cash and cash equivalents at $364 million as of June 30, 2025—a decrease of 21.7% from the previous year-end. The company also had $592.6 million in unused credit capacity.

Segmental Performance

Skilled Services

The Skilled Services segment recorded revenues of $1.17 billion, a 18.4% increase year over year, slightly beating both the Zacks Consensus Estimate and internal projections. The segment’s income rose 22.8% to $150 million, fueled by higher occupancy rates and increased patient days. At the end of the quarter, the segment operated 303 skilled nursing facilities and 31 campus operations.

Standard Bearer

Rental revenues for the Standard Bearer segment increased 34.7% year over year to $31.5 million, driven by buyouts. Segment income rose 24% to $9.1 million. Funds from operations were $18.4 million, up 26.6% from the prior year.

Financial Position and Capital Deployment

Ensign Group ended the second quarter with total assets of $4.9 billion, reflecting a 5.6% increase from the end of 2024. Long-term debt, excluding current maturities, stood at $139.6 million, down 1.4% from the previous year-end. Current maturities of long-term debt amounted to $4.2 million.

Total equity reached $2 billion, a 9.8% increase from the previous year. Net cash generated from operations in the first half of 2025 totaled $228 million, more than doubling year over year.

During the first half of 2025, Ensign Group repurchased shares worth $20 million and paid dividends totaling $7.2 million.

2025 Outlook and Guidance

For 2025, Ensign Group revised its revenue forecast to between $4.99 billion and $5.02 billion, up from the previous range of $4.89 billion to $4.94 billion. The midpoint of the new guidance represents a 17.5% increase from 2024 levels.

Adjusted EPS is expected to be in the range of $6.34 to $6.46, compared to the earlier forecast of $6.22 to $6.38. The midpoint of the updated guidance reflects a 16.4% growth from 2024. The weighted average common shares outstanding are estimated at around 59 million, with a tax rate of 25%.

Zacks Rank and Sector Comparison

Ensign Group currently holds a Zacks Rank of #3 (Hold). In comparison, other medical sector companies such as Tenet Healthcare Corporation (THC), HCA Healthcare, Inc. (HCA), and Edwards Lifesciences Corporation (EW) also reported strong quarterly results.

Tenet Healthcare saw a 74% year-over-year increase in adjusted EPS to $4.02, while HCA Healthcare posted a 24.4% improvement in adjusted EPS to $6.84. Edwards Lifesciences reported an 8.1% increase in adjusted EPS to 67 cents, with sales rising 11.7% year over year to $1.53 billion.

Which one are you watching, Xplorianz? Drop your take on the most underrated pick this week in the comments!. Slide into our inbox Facebook, or tag us on X . Stay sharp, stay weird, and keep Xploring

Disclaimer:

This article is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions, your money, your call. Crypto’s wild, so stay sharp out there!

No Comments