Microsoft Stock Fans, Mark Your Calendars for August 1 2025

Microsoft and the AI Revolution: A New Era of Innovation

Microsoft (MSFT) is at the forefront of a technological transformation that is reshaping the world. As investors watch closely, August 1 could be a pivotal moment in the ongoing AI arms race. Recent reports suggest that OpenAI, the company behind the groundbreaking GPT series, is preparing to unveil its next-generation model, GPT-5, as early as August. This potential launch has significant implications for Microsoft, given its deep partnership with OpenAI and the integration of GPT technology across its products.

The Significance of GPT-5

GPT-5 is expected to represent a major leap forward in AI capabilities. According to industry reports, it will combine the strengths of previous models while introducing new features such as memory, reasoning, vision, and task execution. These advancements could make GPT-5 a powerful tool for handling a wide range of tasks, from coding and data analysis to customer service and tutoring. Alongside the full version, OpenAI plans to release smaller variants like GPT-5 Mini and GPT-5 Nano, catering to different use cases.

The release of GPT-5 comes at a time when competition in the AI space is intensifying. Just weeks before the anticipated launch, Elon Musk’s xAI introduced Grok 4, a new AI model designed to compete with ChatGPT and Google’s Gemini. This highlights the growing importance of AI in the tech landscape and underscores the need for continuous innovation.

Microsoft’s Strategic Position

Microsoft’s investment in OpenAI has been substantial. In 2023, the company invested $10 billion in OpenAI, building on earlier investments from 2019 and 2021. This strategic move grants Microsoft a significant equity stake in OpenAI’s for-profit arm, along with exclusive access to its APIs and models on Azure. Additionally, Microsoft benefits from revenue-sharing agreements and rights to OpenAI’s intellectual property through 2030.

This partnership has proven highly beneficial for Microsoft, allowing the company to offer OpenAI’s technologies to its customers. In fiscal 2024, Microsoft’s Intelligent Cloud segment, which includes its AI cloud services, contributed $105 billion to the company’s total revenue of $245 billion. This demonstrates the strong financial impact of Microsoft’s collaboration with OpenAI.

Microsoft’s Integration of GPT-5

Recent leaks indicate that Microsoft is already testing GPT-5 options within its Copilot interface. This suggests that Copilot may gain access to GPT-5 alongside ChatGPT once the model is officially announced. The Copilot app and website feature a hidden chat mode called “Smart,” which hints at the use of GPT-5 to generate responses. This new mode is described as enabling Copilot to “think deeply or quickly based on the task,” indicating that GPT-5 will combine both reasoning and non-reasoning capabilities.

Microsoft positions Copilot as the most user-friendly generative AI assistant, emphasizing productivity-focused workflows and experiences. Integrating GPT-5 into Copilot would further reinforce Microsoft’s position in delivering seamless AI-powered productivity across its ecosystem.

Key Catalysts for Investors

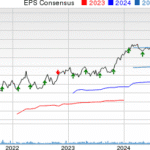

Investors have another key catalyst to watch ahead of the potential GPT-5 release. Microsoft is set to report its fiscal fourth-quarter earnings after the closing bell on Wednesday, July 30. Analysts anticipate double-digit growth in both revenue and earnings, with expectations of an EPS of $3.38 and revenue of $73.81 billion. This strong performance reflects the company’s continued momentum and the positive impact of its AI initiatives.

The primary focus will be on Microsoft’s Azure cloud computing infrastructure business. In FQ3, Microsoft posted Azure revenue growth of 35% year-over-year in constant currency, beating analysts’ expectations. For FQ4, Microsoft projected Azure revenue growth of 34% to 35% in constant currency. The company also mentioned that its cloud AI services have been limited by supply constraints, highlighting the challenges and opportunities in the AI market.

Analysts’ Outlook

Microsoft stock has a consensus “Strong Buy” rating. Of the 46 analysts covering the stock, 38 recommend a “Strong Buy,” five suggest a “Moderate Buy,” and the remaining three advise holding. The mean price target for MSFT stock stands at $553.57, which is just 7.8% above Friday’s closing price. This indicates a positive outlook among analysts, driven by the growing adoption of Copilot and the Azure cloud-computing platform.

In addition to the potential impact of GPT-5, other factors influencing Microsoft’s stock include its capital spending plans and its relationship with AI partner OpenAI. CFO Amy Hood stated that capital expenditures are projected to increase this fiscal year, though at a slower pace compared to fiscal 2025. This suggests a balanced approach to growth and investment.

Conclusion

As the AI landscape continues to evolve, Microsoft is well-positioned to capitalize on the opportunities presented by GPT-5 and other advancements. With its strategic partnership with OpenAI and its commitment to innovation, Microsoft is poised to maintain its leadership in the technology sector. Investors should closely monitor the developments surrounding GPT-5 and the upcoming earnings report, as these could significantly impact the company’s stock performance.

Which one are you watching, Xplorianz? Drop your take on the most underrated pick this week in the comments!. Slide into our inbox Facebook, or tag us on X . Stay sharp, stay weird, and keep Xploring

Disclaimer:

This article is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions, your money, your call. Crypto’s wild, so stay sharp out there!

Top 2025 Premium Cloud Mining Services: Earn Reliable Passive Crypto Income

An Unlikely Quest: From Player to Lifelong Gaming 2025

Top Free PC Games 2025

No Comments