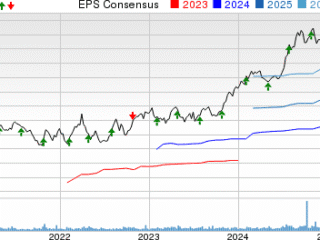

RH Cuts Q2 2025 Earnings Call Revenue Outlook to 9%-11%,

Key Highlights from RH’s Q2 2025 Earnings Call

During RH’s second-quarter earnings call, the company provided a detailed overview of its performance and future outlook. Gary Friedman, Chairman and CEO, emphasized that despite challenging macroeconomic conditions, RH continued to show strong growth. Revenue increased by 8.4%, while demand rose by 13.7%. On a two-year basis, revenue grew by 12% and demand by 21%, reflecting significant market share gains and strategic shifts.

Friedman also highlighted the success of RH England, where gallery demand surged by 76% in the quarter, and online demand increased by 34%. The opening of RH Paris was noted as a major milestone, offering an innovative and immersive brand experience. Early results showed that gallery traffic exceeded that of RH New York, with a design pipeline in the first six days surpassing the combined output of the first five European galleries.

Strategic Shifts and Tariff Impact

The ongoing uncertainty around tariffs has prompted RH to adjust its strategy. Friedman explained that the company is shifting sourcing away from China, with expected receipts decreasing from 16% in Q1 to 2% in Q4. Additionally, the announcement of a new furniture investigation and potential additional tariffs aims to bring manufacturing back to the U.S. However, these developments have led to delays in the launch of a planned brand extension, which is now scheduled for spring 2026 instead of the second half of 2025.

Jack Preston, CFO, reported strong financial performance, with adjusted operating margins rising to 15.1% and adjusted EBITDA reaching 20.6%. Both figures saw a 340 basis point increase compared to the previous year. Net income grew by 79%, and the company generated $81 million in free cash flow during the quarter.

Outlook and Guidance

RH has revised its full-year 2025 guidance, projecting revenue growth between 9% and 11%. Adjusted operating margins are expected to range from 13% to 14%, while adjusted EBITDA margins are anticipated to be between 19% and 20%. Free cash flow is projected to be between $250 million and $300 million. For the third quarter of 2025, revenue growth is expected to be between 8% and 10%, with adjusted operating margins between 12% and 13%, and adjusted EBITDA margins between 18% and 19%.

Management noted that the current outlook does not include any new tariffs resulting from the recent furniture investigation. However, there is a negative 270 basis point impact on operating margins due to investments in international expansion and the opening of RH Paris, along with a 120 basis point impact from tariffs net of mitigations.

Q&A Insights

During the Q&A session, several analysts raised questions about various aspects of the business. Simeon Gutman from Morgan Stanley inquired about real estate monetization, to which Friedman responded that RH is more of a developer than an owner, using a sale leaseback model. He also mentioned that if the right opportunity arose, such as owning property in Aspen, it could be a valuable asset.

Gutman also asked about whether the business was on the cusp of a growth period. Friedman acknowledged that the business is ready but noted that they are moving past the peak of the investment cycle. He expressed more concern about combating inflation than waiting for interest rate cuts.

Steven Forbes from Guggenheim questioned inventory reduction and the risk of launching the new brand extension. Friedman assured that the launch would proceed unless there were unexpected tariffs. Maksim Rakhlenko from TD Cowen asked about Europe’s gallery performance, and Friedman stated that updates would be provided as the Paris and future London and Milan locations develop.

Michael Lasser from UBS focused on discounting and margin outlook, while Steven Zaccone from Citi inquired about tariffs and pricing. Friedman indicated that price increases are likely in the second half of the year, with significant furniture inflation expected across the board.

Sentiment and Risk Analysis

Analysts maintained a neutral to slightly skeptical tone throughout the call, seeking clarity on risk mitigation and confidence in the guidance. Management remained confident, emphasizing strategic separation and adaptability. During the Q&A, Friedman candidly addressed macroeconomic challenges, noting his focus on fighting inflation rather than waiting for rate cuts.

Compared to the previous quarter, management’s tone remained confident but more explicit about tariff risks and strategic delays. Analysts continued to focus on execution details and the sustainability of growth, with increased attention on tariff-driven risks and real estate flexibility.

Quarter-over-Quarter Comparison

Revenue growth and demand acceleration persisted, but the 2025 revenue outlook was adjusted downward from 10% to 13% to 9% to 11%. The international expansion narrative evolved significantly, with RH Paris opening successfully and the new brand extension delayed due to tariff uncertainty.

Both calls emphasized strategic separation, platform investments, and leveraging premium locations. However, the Q2 call featured heightened caution regarding tariffs and inflation. Analysts focused on margin trajectory, international ramp, and inventory management, with more probing questions on tariff-related risks and real estate flexibility.

Risks and Concerns

Management highlighted ongoing dislocation and uncertainty related to tariffs, including a new furniture investigation and the possibility of additional tariffs. There are risks from delayed product launches and shifted revenue due to the timing of the Fall Interiors Sourcebook and tariff disruptions.

To mitigate these risks, RH is shifting sourcing out of China, resourcing upholstered furniture to U.S., Italy, and Mexico factories, and working with vendor partners to absorb tariff costs. Analysts raised concerns about inventory reduction, margin headwinds from tariffs, and the timing of international profitability.

Final Takeaway

Despite navigating a challenging macro environment, RH continues to demonstrate agility and resilience. The company has maintained revenue and demand growth, achieved robust margin expansion, and seen strong early results from its European galleries. While the revised 2025 outlook reflects tariff-related headwinds and strategic delays, RH remains focused on accelerating global expansion and maximizing long-term brand value. Management expressed confidence in the company’s ability to drive industry-leading growth, optimize its asset portfolio, and adapt to evolving market conditions, positioning RH for substantial upside when macroeconomic conditions improve.

Which one are you watching, Xplorianz? Drop your take on the most underrated pick this week in the comments!. Slide into our inbox Facebook, or tag us on X . Stay sharp, stay weird, and keep Xploring

Disclaimer:

This article is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions, your money, your call. Crypto’s wild, so stay sharp out there!

Sanmina Surpasses Q2 Sales Goals, Yet Revenue Outlook Falls Short

Polaris Industries Confronts Challenges in Q2 Earnings Call 2025

Fiserv Plummets on Earnings, Seen as Bargain Q2

ENSG’s Q2 Earnings Surpass Expectations as Occupancy Rises, Stock Jumps 9%

No Comments