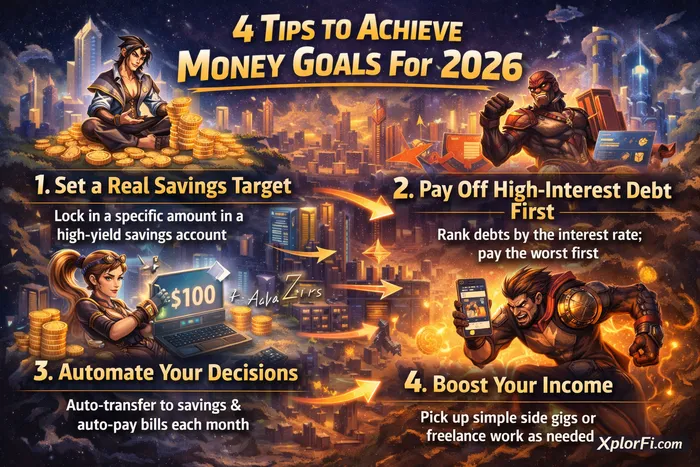

4 Tips to Achieve Money Goals For 2026

Yo yo yo Xplorianz, loyal crew of XplorFi.com.

“New year, new grind, same Money Goals in sight,

If plans are trash, by December it’s another financial fight.”

The first 2 weeks of the new year, of course, are still fresh and enthusiastic in facing the increasingly difficult challenges of life.

If you’re serious about leveling up your Money Goals this year, saving more, killing debt, and finally feeling in control, here’s the cold truth: motivation is overrated, systems are OP. Two people can want the same thing, but the one with structure wins every single time. Let’s break it down XplorFi-style: chill, smart, and actually usable.

Why Money Goals Fail Without Systems (Like Pushing Ranked With No Build)

Every January, millions of people set identical Money Goals: emergency fund, debt-free life, better saving habits. But by December? Only a few actually win.

Why? One relies on vibes and willpower. The other builds systems.

Think of it like Mobile Legends. Same hero, same rank. One player locks in items, emblem, rotation. The other just wings it. Guess who’s feeding by minute five?

According to financial behavior research shared by Vanguard, automation and clarity beat motivation almost every time. Money doesn’t move because you want it to, it moves because you built rails for it.

Set Real Savings Targets (Claude Farming Gold, Not Chasing Kills)

Most people say, “I should save more,” but never decide how much, when, or where. That’s not a plan, that’s a wish.

Kate Byrne from Vanguard Cash Plus explains that the first step is getting specific. Decide how much you can save after non-negotiables like rent, food, and bills. Even $10–$20 per paycheck counts if it’s consistent.

Concrete example:

You earn $2,000/month. After essentials, you can safely save $100. Lock that number in. Auto-transfer it.

And don’t park it in a weak account. Traditional savings accounts average around 0.40% APY, while high-yield savings accounts (HYSAs) offer 3%+. That’s free money.

This is Claude farming gold instead of chasing random fights. Same hero, smarter play.

Put Your Emergency Fund in the Right Place (Angela Charging Energy Before Teamfight)

Your emergency fund isn’t just savings, it’s stress insurance. But leaving it in a low-yield account is like charging Angela’s ult at snail speed.

Byrne points out that placing emergency funds in higher-yield vehicles can earn you $30 more per $1,000 saved annually. Not sexy, but powerful over time.

Concrete example:

$5,000 emergency fund

0.40% APY → ~$20/year

3.50% APY → ~$175/year

Same money. Different system.

Angela doesn’t rush into battle uncharged. Neither should your emergency fund.

Pay Off High-Interest Debt First (Aldous Stacking the Right Targets)

Debt kills progress quietly. Credit cards with 20%+ interest? That’s a debuff you don’t ignore.

Richard Barrington from Credit Sesame recommends the avalanche method: list debts from highest interest to lowest, and attack the most expensive one first.

Concrete example:

- Credit card A: 24%

- Credit card B: 18%

- Personal loan: 9%

Minimum payments on all, extra money to card A first.

Also, check refinancing options. Personal loans or 0% balance transfer cards can reduce interest if you need more time.

That’s Aldous stacking the right souls — hit the strongest target first for max damage.

Automate Your Money Decisions (Layla on Auto-Attack Mode)

Consistency is where most Money Goals die. Robert R. Johnson, finance professor at Creighton University, reminds us of Warren Buffett’s rule:

“Spend what’s left after saving.”

Automation makes that happen without relying on discipline.

Concrete example:

- Payday → auto-transfer $100 to HYSA

- Auto-pay minimum debt

- Auto-invest fixed amount monthly

You don’t “decide” anymore. The system decides.

That’s Layla on auto-attack, steady damage, no panic clicking.

Boost Your Income When Cutting Isn’t Enough (Roger Taking Jungle Camps)

Sometimes budgeting harder isn’t the answer. Leslie Tayne, founder of Tayne Law Group, says increasing income can speed everything up.

Side gigs don’t have to be dramatic.

Concrete examples:

- Food delivery once a week

- Freelance design or writing

- Renting unused items

- Selling digital products

Even $200 extra per month can fast-track savings or debt payoff.

That’s Roger clearing jungle camps between lanes, not flashy, but effective.

Systems Beat Motivation Every Time (Tank Protecting the Core)

The biggest lie about Money Goals is that you just need more motivation. Nope. Motivation fades. Systems don’t.

When savings auto-move, debt auto-decreases, and income has backup streams, progress happens even on lazy days.

External studies from CNBC and NerdWallet consistently show that automated savers outperform manual savers, not because they’re smarter, but because friction is removed.

That’s the tank doing their job. You don’t notice it, but without it, the team collapses.

The Bottom Line: Same Goals, Better Build

Your Money Goals for 2026 probably look a lot like 2025’s. The difference this year isn’t what you want, it’s how you set it up.

Specific targets. Better accounts. Smart debt order. Automation. Extra income lanes.

Same hero. Better build. Higher rank.

And that’s how you stop making resolutions, and start stacking wins.

See you at the top of the leaderboard,

Your finance homie from XplorFi.com

Disclaimer: This content is for educational and entertainment purposes only (XplorFi style). Nothing here is financial advice. The crypto market is volatile; you can lose your lunch money. Do your own research (DYOR) before buying anything.

READ MORE:

No Comments